info@alicoltd.co.uk

info@alicoltd.co.uk 0208 470 9300

0208 470 9300 383 A Green Street, Upton Park. E13 9AU

383 A Green Street, Upton Park. E13 9AU

What is this guide and why is it important?

This guidance is made to outlay the importance of complying with the law and defining Anti Money Laundering (AML), Counter Terrorist Finance (CTF) and Counter Fraud Procedures. It will also include a brief description of the policies and procedures. Sanction list and risk-based approach will be explained with examples of how money can be laundered and how to stop it.

This guide will helps us:

The money laundering legislation in the UK

Under the Money Laundering and Terrorist Financing Regulations 2019 (MLRs), the company is obliged to provide all members of staff training on the law relating to money laundering/counter terrorist financing. We ensure that all our staff member have read the legislation so that they are aware of the potential criminal offences and the penalties. Where appropriate, HMRC guidance on the legislation is included to avoid confusion. Staff will be tested on their knowledge of the law as we are obliged to ensure that they are aware of it.

The regulations set against money laundering are:

Alico (UK) Limited responsibilities is to maintain with the regulations. Therefore, Alico (UK) Limited have appointed a Money Laundering Reporting Officer (MLRO) who will carry out regular audit on compliance with the regulations such as

Key facts about Alico (UK) Limited

To get in touch with our compliance officer please see below email address and our office

Director / MLRO Name: Mr. Qaisar Syed

Phone: +44 020 8470 9333

Email: alicoexchange@hotmail.com

Branches:

Alico UK Ltd currently has 4 branches and the senior management is committed to strictly monitor the compliance level of all branches with the policy and procedures of Alico UK Ltd. All Branches have been frequently visited by internal and external compliance officers on regular basis to ensure that the branches are complying with company's policy and procedures on anti-money laundering terrorist financing, fraud prevention, record keeping, and training.

1: Peckham

Unit 22, 137-139 Rye Lane Peckham London SE15 4ST Tel: 02072778598

2: East Ham

8 Station Parade, High Street North, East Ham E6 1JD

3: Southall

18B The Broadway, Southall UB1 IPS, T: 0205716661

4: Walthamstow

227 High Street, Walthamstow E17 7BH, T: 02085210999

Staff training and awareness

All employees are given the appropriate training and are responsible for reading the AML manual, understanding their responsibilities, and acting accordingly. Ensure that company procedures are followed and all documentary evidence is obtained as specified in the manual. Ensure that all suspicious events are reported to MLRO. This training is conducted by the Compliance Officer or the compliance Trainer.

Nominated Officers/MLROs, senior managers and others involved in ongoing monitoring of business relationships and other internal control procedures will need different training, tailored to their particular functions.

Staff training is necessary when staff join the business, move to a new job or when they change roles.

Alico (UK) Limited gives training its entire staff every 12 months as part of ongoing staff training, to make staff aware of changing behaviour and practices amongst money launderers and those financing terrorism.

Safeguarding

Alico (UK) Limited is well aware of its obligation of safeguarding of funds as stated within the Electronic Money Regulations 2011 (EMRs) and Payment Services Regulations 2017 (PSRs).

How do we comply with duty?

The objective of the safeguarding rules is to consider what would happen to our client's funds in the unlikely event that our firm went into administration. When we receive funds in relation to a trade, the money is received into a client bank account. Those client accounts are not commingled with firm money and in the unlikely event of administration, no other creditors can have access to these funds. We conduct daily reconciliations to ensure that the client balances as per our internal records corresponds to the funds held in the client accounts.

Data protection

The data protection legislation, i.e. the data protection act 2018 and the general data protection regulation (GDPR) governs the processing of information relating to individuals, including obtaining, holding, use or disclosure of information.

Personal data obtained by a business under the regulations may only be processed for the prevention of money laundering and terrorist financing unless use of the data is allowed by other legislation or after obtaining the consent of the data subject.

Alico (UK) Limited has a Data Protection policy which covers that personal data will only be used for the purposes of preventing money laundering and terrorist financing and provide them with the information as required under article 13 of the GDPR.

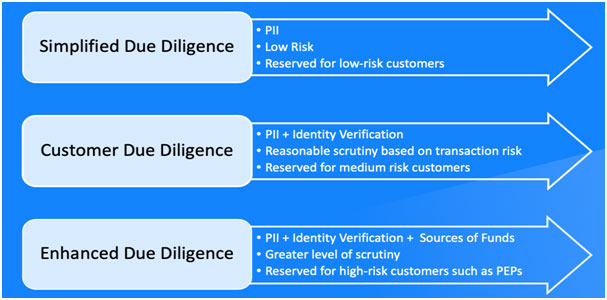

Customer due diligence and transaction processing

Customer due diligence means taking steps to identify our customers and checking they are who they are by asking government issued photo document and an official document; such as passport, driving license, utility bill and bank statement. Other sources of customer information include the electoral register and information held by credit reference agency.

What is customer due diligence?

The meaning and application of customer due diligence is set out inFinancing (Amendment) Regulations 2019regulation 27 and paragraph 10 of Schedule 7 to the Counter Terrorism Act 2008.

These regulations require businesses to:

This regulation applies when a relevant person is required by regulation 27 to apply customer duediligence measures.

Beneficial ownership:

A business relationship exists where the company sets up a process with the customer which makes it easier for them to make regular transactions. It is our company policy that a business relationship exists in one of the following situations:

In situations where a business relationship exists, there is an obligation to obtain a proof of ID, plus confirmation of purpose of transaction and source of funds. There is an obligation on the company to monitor all transactions carried out in the business relationship (see transaction monitoring).

We know how to identify the existence of any beneficial owners (the section on customer due diligencegives information on who is abeneficial owner). We verify the beneficial owner's identity so that we are satisfied that we know who the beneficial owner is. If it is a legal person we takereasonable measures to understand the ownership structure.

We will not have satisfied our obligation to identify, verify and understand the structure of a beneficial ownership if we rely solely on the information contained in a register of persons withsignificant control.

Where a customer is incorporated and in exceptional circumstances, where we have made unsuccessful attempts, and have exhausted all ways, to identify the beneficial owner of a corporate body we may treat the most senior person managing the customer as the beneficial owner. We will keep records of all the steps we have taken to identify the beneficial owner and why they have been unsuccessful.

Identifying all 'beneficial owners', where applicable, and taking adequate risk-based measures to verify their identity. This may be because we need to establish the ownership structure of a company, partnership or trust. The beneficial owner is the person who's behind the customer and who owns or controls the customer or it's the customer on whose behalf a transaction or activity is carried out.

If we have doubts about a customer's identity then we stop dealing with them until we are sure

Alico (UK) Limited do customer due diligence when:

Occasional transaction

An occasional transaction is a transaction of (or the sterling equivalent) that is not part of an ongoingbusiness relationship. It also applies to a series of transactions totalling £10,000 or more, where thereappears to be a link between transactions (linked transactions).

Linked Transactions

It is company policy that transactions are 'linked' when the following criteria apply:

Non-compliance with customer due diligence

If we find that customer is not complying while performing the customer due diligence measures, then we do not: -

Identifying Individuals

As part of our customer due diligence measures, we identify individuals. We obtain a private individual's full name, date of birth and residential address as a minimum. We verify these using current government issued documents with the customer's full name and photo, with a customer's date of birth or residential address such as: -

When verifying the identity of a customer using the above list of government issued documents, we take a copy and keep it in the customer's file.

Where the customer doesn't have one of the above documents, we ask for the following: -

A government issued document (without a photo) which includes the customer's full name and also secondary evidence of the customer's address, for example an old-style driving licence or recent evidence of entitlement to state or local authority funded benefit such as housing benefit, council tax benefit, pension, tax credit.

Secondary evidence of the customer's address, not downloaded from the internet, for example a utility bill, bank, building society or credit union statement or a most recent mortgage statement.

If Alico (UK) Limited verify the customer's identity by documents, Alico (UK) Limited see the originals and not accept photocopies, nor accept downloads of bills, unless certified as described below: -

Photocopy's identity documents can be accepted as evidence provided that each copy document has an original certification by an appropriate person to confirm that it is a true copy and the person is who they say they are for standard customer due diligence an appropriate person is for example a bank, financial institution, solicitor or notary, independent professional person, a family doctor, chartered accountant, civil servant, or minister of religion.

Alico (UK) Limited check the documents to satisfy ourselves of the customer's identity. This may include checking: -

If a member of our staff has visited an individual at their home address. A record of their visit may corroborate the individual's residential address (instead of the need for a second document). This is covered in the risk assessment.

Where an agent, representative or any other person acts on behalf of the customer we ensure that they are authorised to do so, identify them and verify the identity using documents from a reliable and independent source.

Transaction monitoring

The number and volume of transactions going through the company will be monitored, together with scrutiny of transactions, according to risks parameters relating to

The MLRO reviews all the transactions which are being processed by each customer. This means the MLRO reviews on a daily, weekly and monthly basis whether the volume of transactions which is being processed by the customer is consistent with what was anticipated when the customer was registered, keep a watch out for a sudden increase in business from an existing customer, look out for uncharacteristic transactions which are not in keeping with the customer's known level of activity, lookout for peaks of activity at particular locations or at particular times, lookout for unfamiliar or untypical types of customer or transaction, lookout for transactions related to potential sanctions list matches or PEP's.

Know your customer (KYC)

KYC requirement are key aspects in Alico (UK) Limited relationships with its clients. The requirement to carry out customer due diligence and enhanced due diligence has given it an increased importance as it needs taking steps to identify our customers and checking they are who they say they are. KYC is a keystone in the fight against money laundering, serving to ensure our dealings are with genuine customers and organisations, and assisting in the identification of suspicious behaviour.

Obtaining the KYC information is only the first step to understanding with whom we are dealing. Alico (UK) Limited system is designed in a way that it continuously reviews the customer's data with Risk Based approach in mind and when its necessary system will automatically request additional information on that customer account. This is to enable us to know enough about the customer and it is reasonably satisfied that they are genuine and do not pose a significant money laundering risk. We therefore apply this policy with this objective in mind.

Customer Document Verification

Customer are advised to upload proof of identification when sending money such as Photo ID, Proof of identifications which will be accepted are the following

Please Note: Proof of identification is checked any expired documents or counterfeit papers will not be processed, please also be ensure that all Photo ID's and confidential documents are highly protected on our server.

Changes and modifications to client's details

Up-to-date information are kept of our customers so that we can:

Changes of circumstance may include:

All customers are made aware that information is held for 5 years - random checks may be made on information supplied and if any details are incorrect, customers will be suspended from the system until the customer supplies the updated personal information. Our Staff particularly take care to make sure that customer ID information previously supplied is still valid (and that ID documents have not expired). Any customer address information provided is re-verified at least every twelve months.

When to accept or decline a transaction

It is company policy that a transaction are declined in the following circumstances:

Enhanced Due Diligence (EDD)

Enhanced due diligence (EDD) is a KYC process that provides a greater level of scrutiny of potential business partnerships and highlights risk that cannot be detected by customer due diligence. EDD goes beyond CDD and looks to establish a higher level of identity assurance by obtaining the customer's identity and address, and evaluating the risk category of the customer.

Enhanced due diligence is specifically designed for dealing with high-risk or high-net worth customers and large transactions. Because these customers and transactions pose greater risks to the financial sector, they are heavily regulated and monitored in order to ensure that everything is on the up and up.

When to carry out enhanced due diligence

In some situations, we carry out 'enhanced due diligence'. These situations are:

Financial Sanctions

UK financial sanctions apply within the territory of the UK and to all UK persons, wherever we are in the world.

Alico (UK) Limited undertake activities within the UK's territory and would comply with the UK financial sanctions that are in force. Alico (UK) Limited is established under UK law, including our branches, also comply with UK financial sanctions that are in force, irrespective of where their activities take place.

ID System

After registration of clients, a unique ID number will be assigned. Clients are obliged to use their Unique ID Number in all communications and transactions with us for security purposes. The outcome is that we can assure that we only deal with the right person and prevent usage of client's account by others. Identity checks are done by asking security questions such as date of birth, postcode, and contact numbers.

These checks are strictly implemented before proceeding with the transaction.

Business Monitoring

It is the responsibility of the MLRO to monitor all the activity of the business with particular reference to the potential financial crime risk. The MLRO will keep a close eye on the following criteria and provide a report to senior management when required.

Alico (UK) Limited have set rules to prevent the system to prevent transactions and cause inconvenience to the clients:

Monitoring customer activity helps to identify unusual activity. If unusual events cannot be rationallyexplained, they may involve money laundering or terrorist financing. Monitoring helps give greaterassurance that our company is not being used for the purposes of ML or TF.

Ongoing monitoring means first, scrutinizing transactions to ensure that the transactions are consistent with our knowledge of the customer and his or her normal activity and risk profile, and secondly ensuring that the documents, data or information that provide evidence of the customer's identity are kept up-to-date.

If, over time, a customer's cumulative value of transactions reaches £10,000, we review the customer's activity, and repeat the review with every further £5,000. This 'milestone review' involves assessing the customer's pattern of behaviour such as the amounts sent on each occasion and the frequency of sending.

Record Keeping

The records that Alico (UK) Limited, keeps:

We also maintain:

Transaction and business relationship records (for example, account files, relevant business correspondence, daily log books, receipts, cheques, and so on) are maintained in a form from which a satisfactory audit trail may be compiled, and which may establish a financial profile of any suspect account or customer.

How long the customer due diligence records are kept?

We keep records of customer due diligence checks and businesstransactions:

The records are reviewed periodically to ensure, for example, that a fresh copy documents is held.

Our risk assessment and policies, controls and procedures are kept up to date and be amended to reflect any changes in our business.